Check your online loan options

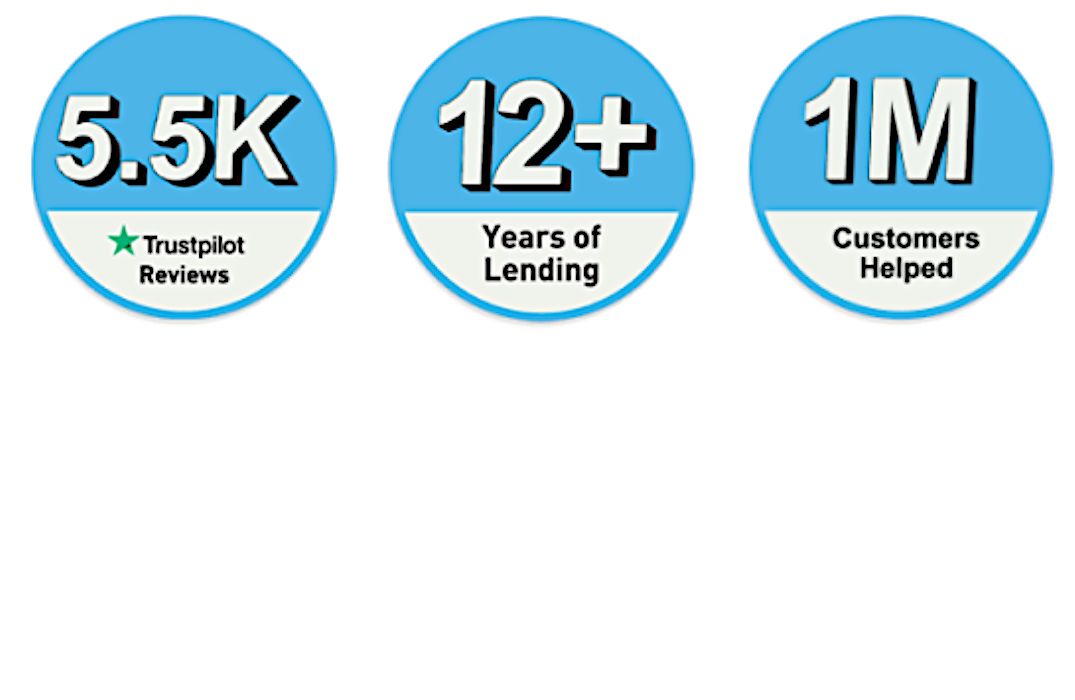

See why over one million people have chosen RISE

Quick Application Process

Borrow online loans on your own terms

5-Day Risk-Free Guarantee

Instantly check your credit score for free

Quick Application Process

Borrow online loans on your own terms

5-Day Risk-Free Guarantee

Instantly check your credit score for free

Get started in three easy steps

Get started in three easy steps

Apply in Minutes

It’s easy. It’s secure. It’s all up to you. Start your loan application now and you could be approved to receive cash as soon as tomorrow.*

Choose Your Own Terms

With flexible payment scheduling†, you can choose your loan terms and the loan amount that suits your needs. And if that means paying off your loan early, feel free. Not only are there no additional fees if you do, but you could save on the cost of your loan.

†State restrictions apply to payment schedule options.

Cash in Your Bank Account

Funds can show up in your checking account as soon as the next business day*.